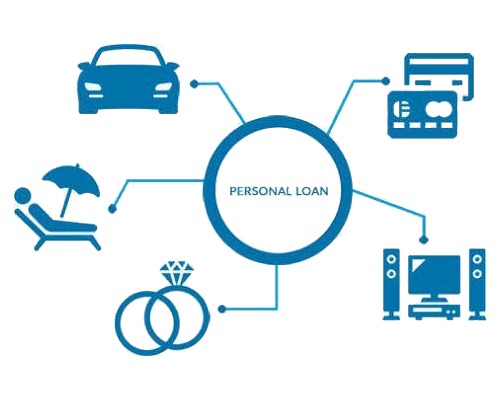

Personal Loan is an unsecured loan that is generally used for a personal purpose. This type of loan could be used for paying off debts, going on vacations, buying appliances and latest gadgets, home improvement, unexpected medical expenses, and so forth. The banks calculate the eligibility of the borrower before approving the loan application. A Personal Loan is offered based on the credibility and repaying capacity of the borrower. The funds from a Personal Loan could be used for any type of expense as per the convenience and requirement of the borrower. As a Personal Loan does not require any security or collateral, the rate of interest charged is comparatively higher than other types of loans. Unlike the high rate of interest, the loan tenure is shorter than the other types of secured loans and can be used for any personal need.

What is a Personal Loan?

Fresh Personal Loan For Salaried

Be it your child’s education or wedding; a long-awaited holiday or buying yourself latest gadgets, you always want the best for your family. In times of need, in case of any unforeseen circumstances or in case of a medical emergency, you give it your best shot to keep your family safe and happy.

With personal loans for salaried class, we support you in fulfilling you needs!

- QUICK APPROVAL

- HIGH LOAN AMOUNT – 1 to 30 lacs.

- SPECIAL CORPORATE RATES EVERY MONTH

- FLEXIBLE TENURE – 1 – 5 years.

- NO SECURITY/GUARANTOR – For Easy, Faster approvals.

- CONVENIENCE – Hassle – free documentation at doorstep.

- BEST OFFERS FROM OUR TIE-UPS WITH DIFFERENT BANKS AND NBFC’S.

Our USP

Tie-ups with several institutions to get you the best offer.

Expertise in providing end-to-end financial solutions with all type of fund raising requirement.

A dedicated team to track and deliver in time.

Balance Transfer Top-Ups

A ‘Balance Transfer’, simply transfers your existing personal loan to a new financial institution and helps you save a lot of money and helps you manage your monthly expenses. Following are the benefits of doing a balance transfer with us:

- REDUCED RATE OF INTEREST FASTER APPROVAL

- REDUCED EMI

- ADDITIONAL FUNDS WITH NO/SMALL INCREASE IN YOUR EMI’S.

- EMI CONSOLIDATION : Merge your multiple personal loans/credit cards to one loan and reduce your monthly EMI burden.

‘Top-up’ simply happens on your existing personal loan with a simple process. Following are the benefits of taking a top-up from the same bank:

- MINIMUM DOCUMENTATION

- BEST POSSIBLE RATE ON INTEREST

- LOWER EMI BURDEN

- FAST APPROVAL

Our USP:

- Lowest rate possible in Balance Transfer and Top-up by our expertise.

- Maximum amount with minimum EMI and flexible tenure.